about able

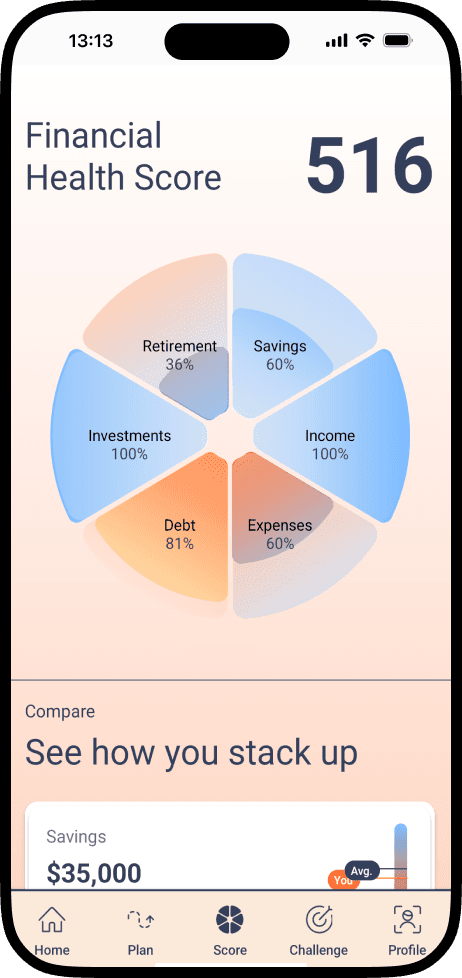

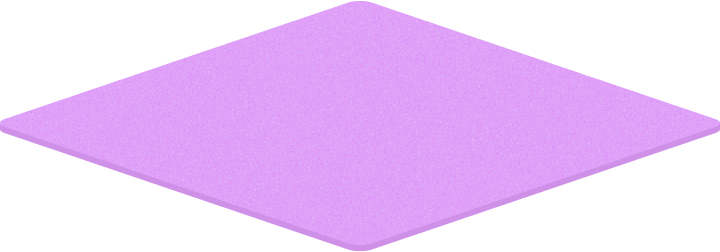

Discover your Financial Health Score and understand where you stand. Gain insights into your strengths and areas to improve.

You're Not The Problem

You've Just Never Had

The Right Tool.

Managing money shouldn't feel like a second job—or a source of shame. You've tried to budget. You've cut back where you could. You've searched for answers online. But no matter what you do, it still feels like you're guessing.

Able Helps You See Your Full Financial Picture

- Cash Flow Management

Focuses on the day-to-day movement of your money. It combines your income and expenses to help you understand your financial position and ensure you're spending less than you earn.

- Financial Health & Stability

Building a strong financial foundation. It covers managing your debt to reduce financial burdens and building up your savings to create a safety net for unexpected events or future goals.

- Future & Wealth Building

Focuses on the day-to-day movement of your money. It combines your income and expenses to help you understand your financial position and ensure you're spending less than you earn.

The Financial Companion That Actually Gets You

We built able for people who are doing their best, but still feel like they're falling behind. No lectures. No guilt. No pressure. Just real support, right where you are.

Your Score

A simple snapshot of your financial health

Start with a personalized Financial Health Score that gives you a full picture of where you stand across saving, spending, debt, investing, and more.

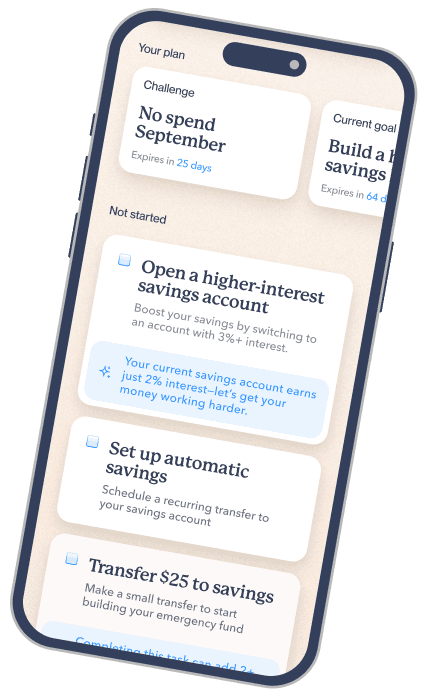

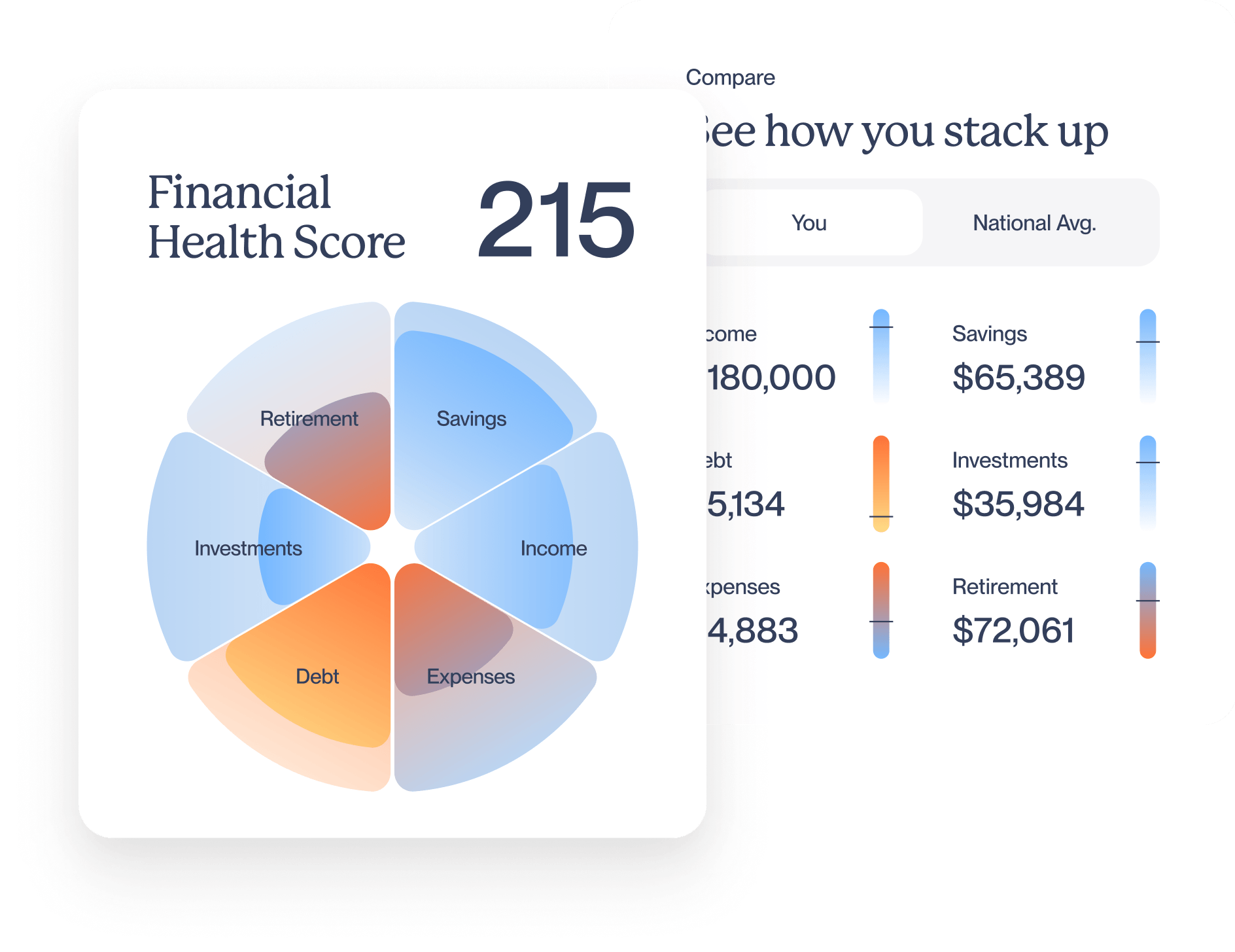

Your Plan

Clear, essential next steps tailored to you

We'll show you what to focus on next with a list of essential tasks tailored to your goals, your situation, and your pace. No more guessing.

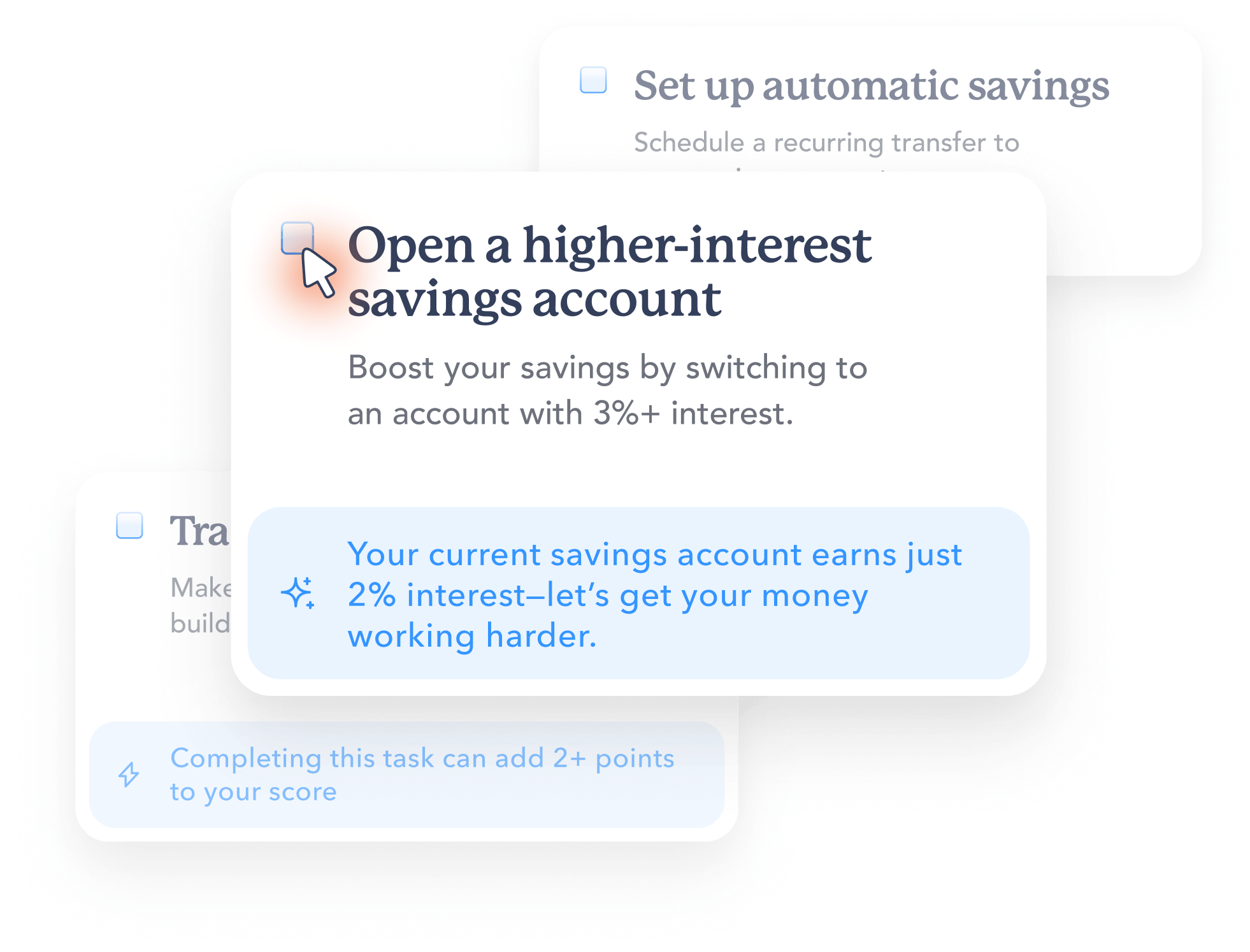

Your Progress

Progress that feels doable, not overwhelming

Build better money habits through challenges you can take on solo or with the ABLE community. Small wins that lead to real momentum, one clear step at a time.

What Life With Able Feels Like

Built By A Nonprofit. Backed By 45 Years Of Experience.

Able is a product of Objective Measure, a nonprofit dedicated to helping people live wisely with money.

It's grounded in the financial insights of Fred Martin, an investor with over four decades of experience, and created for real people who want real progress.

" Financial health starts with clarity, not complexity."